News & Events

2016-12-01: How to invest in overseas projects? CCAA tells you that “2016 Angel Investment Agency is a new pioneer”

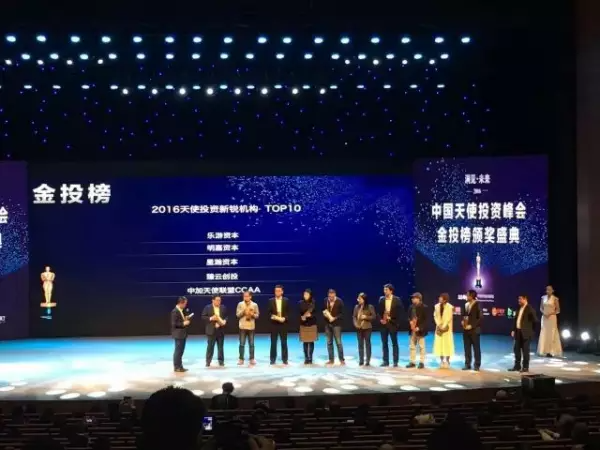

“Insight · Future – 2016 China Angel Investment Summit Forum and Award Ceremony” is an annual event in the angel investment industry. With the theme of “Insight · Future”, we invited top leaders in the investment industry to jointly look forward to the future development of science and technology, discuss the future development of hot areas such as artificial intelligence, big data, consumption upgrading, and see the future trends of investment and entrepreneurship. The China Canada Angel Alliance won the “2016 Top 10 Angel Investment Institutions”.

Technological innovation changes the world

Based on the social environment with a large population in China, as well as the blind spots and new demands exposed in the rapid development of China’s economy, Chinese entrepreneurial teams have inherent advantages and conditions in mode innovation. The huge population and the number of Internet users have created a number of excellent entrepreneurial enterprises. However, by contrast, the lack of technology accumulation and the immaturity of the process from laboratory to industrialization make excellent technological innovation enterprises polish excellent products and face certain challenges. However, the investment in R&D by leading research institutions, large enterprises and a complete intellectual property protection system accumulated over the years overseas have led to the existence of a large number of excellent technological innovation oriented enterprises overseas. Therefore, overseas investment is more suitable for technological innovation projects, including applied technology and underlying technology.

Concentrate on products and endure loneliness

The domestic environment for mass entrepreneurship and innovation has enjoyed unique advantages in terms of policies in recent years, and no country or region can temporarily compare with the domestic entrepreneurial environment. However, such an environment is also doomed to create a mixture of good and bad in the market. The foam in the valuation of some projects has become bigger and bigger, and entrepreneurial teams are eager for quick success and short-term benefits, and pay more attention to business model innovation without solving the actual pain points. By contrast, in some overseas regions, as the venture market is more mature, entrepreneurial teams and projects are more patient and devote themselves to product development. Funds that are tolerant of the growth of enterprises are willing to accompany these enterprises to endure loneliness.

Value depression, investment target

In addition to the great ideal of changing the world, it is also an important choice for investment institutions to obtain investment income. In the mature overseas investment market, how to obtain projects in low-value areas is a test of the core competence of investors. In addition to building a professional investment team overseas, CCAA has also established deep contacts with local investors, and well-known domestic investor teams will also visit overseas for at least two months each year to interview with overseas investment teams on projects. The introduction of suitable overseas projects into domestic development is also a new small step that CCAA is striving for.

Up to now, the China Canada Angel Alliance (CCAA) has invested 31 projects, totaling more than CAD 5 million, focusing on technological innovation projects, including bottom level technological innovation and application level technological innovation, such as artificial intelligence, life sciences, the Internet of Things, blockchain, new materials, etc. Technological innovation enterprises pay attention to technical barriers and difficult to replicate. The China Canada Angel Alliance (CCAA), together with Zhongguancun Haidian Park, Canada Ontario Center of Excellence, and Dahe Venture Capital, organized North American projects invested by CCAA to visit China. Among them, 40% of the teams participating in the investigation in 2015 have obtained the next round of financing. And the North American team has landed in China with the assistance of Dahe Venture Capital.

The 2016 China Angel Investment Financial Investment List, jointly sponsored by Beijing Municipal Government, Beijing Municipal Finance Bureau, Beijing Municipal Science and Technology Commission, Beijing Municipal Commission of Economy and Information Technology, Haidian District Government, Haidian District Finance Office, Haidian District Investment Promotion Bureau, Zhongguancun Management Committee, Zhongguancun Development Group and other units, was officially announced on December 1, 2016. China Canada Angel Alliance won the “2016 Top 10 Angel Investment Institutions”.

Wang Tong, founding partner of China Canada Angel Alliance (CCAA), said that compared with domestic projects, overseas projects are more focused and patient in technology, and have their own uniqueness in the field of scientific and technological innovation. CCAA is willing to support the development of overseas projects with patience, time and excellent domestic and foreign resources. The layout in North America in the previous two years is just the first step. In the future, we will continue to expand the investment area, explore more excellent projects, and make a modest contribution to changing the world.