Martin, an Iranian young man who is talking freely, gives Zhang Yiqin a glimpse. Martin is the director of Applyboard, an entrepreneurial project in Canada. His company uses AI technology to achieve more accurate matching, help foreign students from all over the world who want to study in North America and Europe find appropriate schools and courses, and help schools speed up the application review process.

“Martin is an entrepreneur who is extremely enthusiastic and has a strong business sense. As an immigrant, he is a dreamer who has a strong desire to change the status quo and is willing to make efforts for it. He has the temperament of a real leader and is the entrepreneur we want to see”, said Zhang Yiqin. “He convinced me the first time we met.”.

Applyboard Home Page

Zhang Yiqin is the founding partner of Zhongguancun Dahe Capital. In 2015, he went to Canada for the first time, and together with his team, he looked for potential entrepreneurial enterprises here, and he saw the soon established Applyboard at a glance. At that time, Canada was still a “value depression” that few Chinese investors set foot in.

The first batch of Chinese investors to land in Canada.

The idea of investing in Canada originated from Liu Zhishuo, founding partner of Dahe Capital. In 2014, he accompanied his wife Liu Yingna, who immigrated to Canada, to pay attention to local projects suitable for investment.

Wang Tong, another founding partner of Dahe Capital, told the media: “There are two main ways for Chinese VC’s early investment to go to sea: one is to go to Vietnam, Indonesia, India and other Southeast and South Asian countries; the other is to go to the United States, Canada, Israel, Germany and other high-tech countries.”

The United States was the commanding height of scientific and technological innovation. At that time, most investors focused on Silicon Valley, but this also meant fierce competition. Wang Tong said, “If we want to systematically establish an investment ecology in the United States, it is difficult, so we have transferred the main battlefield to Canada.”

For a long time, Canada has been regarded as the “backyard” of the United States and ignored. However, the high-quality educational environment, diversified and high-quality population composition, and the emphasis on science and technology have rapidly made the country a gathering place for entrepreneurial projects in recent years, and a large number of locally grown science and technology entrepreneurial star projects have been brewing. Google, Facebook, Amazon, Twitter and other companies have also set up R&D centers or branches in several important cities in Canada, which has become the “Northern Silicon Valley”.

Photo by Austin Distel on Unsplash

Canadian local start-ups also have a strong demand for external funds and foreign markets. Liu Zhishuo previously said: “We know that there are many important opportunities here, and technology companies are more eager to access the Chinese market than ever before.”

In 2014, the China Canada Angel Alliance (CCAA), an investment institution dedicated to building a cross-border ecosystem between China and Canada, was established, becoming a new attempt for Dahe Capital to go abroad.

A ten day “whirlwind tour” to visit dozens of institutions

“Airborne” to a completely unfamiliar market, how to get through local contacts and find suitable projects has become a key issue.

Yang Jun, vice chairman of the China Canada Angel Alliance, was one of the first members to join the team. He witnessed the process of Chinese angels as “intruders” breaking the ice.

“Although we are investors, at the beginning, we were similar to entrepreneurs. At that time, angel investors in Canada were a relatively closed circle, and there were almost no Chinese faces.” Yang Jun said, “The Western style was relatively slow. We joined some local organizations and associations. After we had preliminary contact with them, they would ‘investigate’ for a period of time to see if we were really doing something, If you think it is more reliable, come back to discuss with us and gradually build trust. “

Through the early efforts and communication between Liu Yingna and Yang Jun, the China Canada Angel Alliance began to see some opportunities. So Zhang Yiqin flew from Beijing to Canada and, together with Liu Yingna and Yang Jun, embarked on a 10 day journey of “gold mining” from more than 100 entrepreneurial projects.

Liu Yingna described it as a “whirlwind investment trip”. Zhang Yiqin felt “tired and happy” at that time.

It was a cold winter in Ontario. In the snowstorm, they drove for several hours every day to visit dozens of investment alliances, incubators and intermediary service agencies to listen to their introduction of local ecology and project promotion. They held high-intensity back-to-back meetings to sort out the fundamentals and investment value analysis of companies. Zhang Yiqin said that the ten days were full of excitement brought by the first direct communication with Canadian peers and entrepreneurs, and he did not feel tired at all by the ten hour daily meetings and the almost inverted jet lag.

In 2013, Zhang Yiqin, Liu Zhishuo and Wang Tong established Dahe Capital. After two years of development, the fund size has exceeded 1 billion yuan. They are not confused when they are young. They are energetic and bold in their investment style. Whether they have the potential for high returns is one of the important factors to consider the project.

In Canada, local “angels” are often old enough to live in their prime. They become angel investors out of social feedback or support for the younger generation. High returns are not the main goal.

They mostly gather together in the form of alliances, and rarely set up special fund management companies. The investment amount of each project is also small, and the amount of individual contribution can be at least several thousand Canadian dollars. The call capital mechanism is mainly based on the specific case by case of each project. Due to its loose form, an investment decision of the whole alliance often lasts for months or even half a year. This contrast of “one less, one older, one more, one less, one faster, one slower” created a wonderful chemical reaction between the two sides.

Zhang Yiqin felt that the local investors were not unsuspecting at first when they came from China and had mastered the investment scale of hundreds of millions of Canadian dollars at the age of 40. However, in just a few days, the investment team of the China Canada Angel Alliance has brought them sufficient capital, professional due diligence and rapid and decisive investment decisions, which have impressed them with admiration.

He said: “They all thought it was very efficient and refreshing to talk about projects with Chinese investors. So even though our overall capital was not large at that time, we got the best project recommendation.”

The group image of local entrepreneurs is also different from that of China. Zhang Yiqin believes that there are many continuous entrepreneurs in Canada, most of whom are in their 30s or 40s or even older. In China, entrepreneurship is more like the patent of young people. He said: “Their entrepreneurial motivation is also more ‘pure’. Many people regard entrepreneurship as a part of their life and do not deliberately pursue the expansion of the company scale. ‘Small and beautiful’ also enjoy themselves.”.

Yang Jun also mentioned that Canadian entrepreneurs are more patient than some domestic entrepreneurs who “work hard and quickly”. Many people just see a problem at the beginning of their entrepreneurship and devote themselves to research and solve it, so they often do solid research and development in the early stage.

“At that time, as a Chinese investor, I was worried for the founders when they talked about the company’s development pace and planning slowly. I was a very efficient person, and I couldn’t accept the pace at all,” said Zhang Yiqin, “But now, as I grow older, I am also constantly thinking about what kind of mentality to use to look at entrepreneurship. I see that many entrepreneurs in China have a strong sense of utilitarianism, and young people are eager to change their destiny through entrepreneurship, not to solve the pain points of the industry. If they can look at entrepreneurship with an ordinary mind, the whole industry will develop more healthily.”.

Ten days later, after visiting dozens of local angel alliances, technology incubators, intermediary services and other institutions, and evaluating hundreds of entrepreneurial enterprises, Canada China Angel Alliance finally decided to invest in nine enterprises, including Applyboard. What they bring is not only sufficient financial support, but also the possibility for entrepreneurs to go further.

Focus on supporting deep science and technology, and bring the team to China.

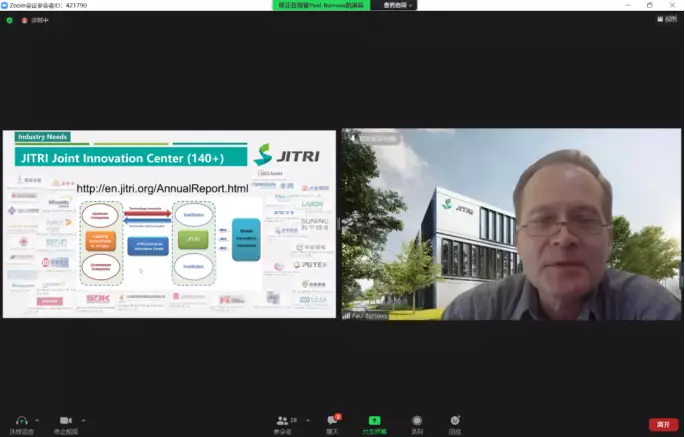

The China Canada Angel Alliance focuses on “deep science and technology” projects, that is, technologies that are deeply cultivated in a cutting-edge science and technology field. The alliance not only solves their financial problems, but also helps them combine their technology with the broad Chinese market.

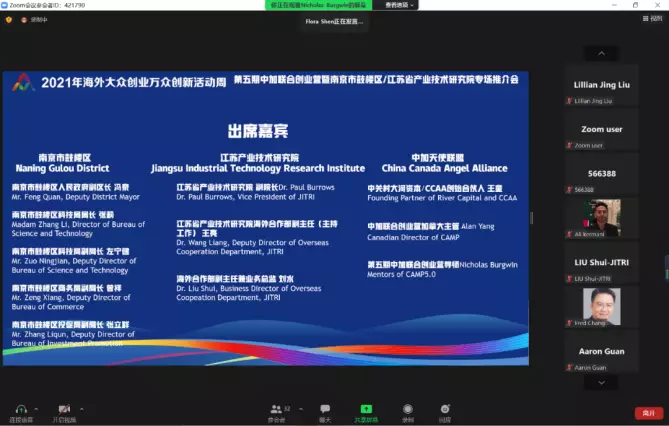

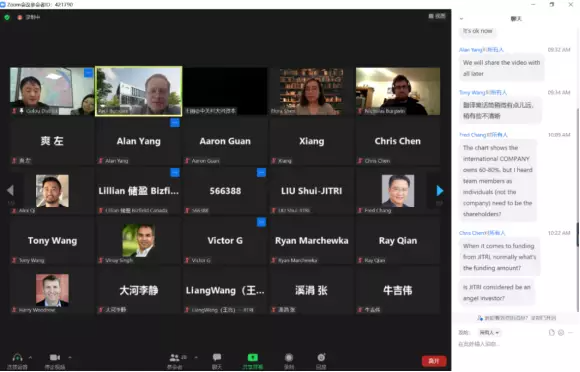

Since 2015, the alliance, together with the Ontario Center of Excellence, has jointly launched the “China Angel Investment and Entrepreneurship Training Camp (CAMP)”. Every year, 10 selected entrepreneurial enterprises are invited to China to visit, face to face with investors and potential partners from China, and “hand to hand” to help them understand China’s business environment.

Fibos, headquartered in Toronto, is an optical sensor manufacturer. Its products can cope with the high temperature, nuclear radiation and high electromagnetic interference of more than 1000 degrees, and the measurement data is more continuous and reliable than traditional methods. Nicholas Burgwin, the co-founder of the company, visited China for two weeks with the startup camp in 2019.

He said that the market in Canada is very small, and it is difficult for local entrepreneurs to have enough R&D funds to further develop deep science and technology. In this case, most companies want to turn to the American market. However, for some industries, China has more developed technology and faster development than the United States. However, due to lack of understanding, China is an attractive place for local enterprises, but everything is unknown.

He said: “China Canada Angel Alliance not only invests in enterprises, but also helps us to connect with the Chinese market. When you want to enter the international market, finding the right people is the most important. Otherwise, once you return home, it will be difficult for both sides to implement their commitments at that time and continue to promote the development of cooperation. This is the advantage of China Canada Angel Alliance. He knows what you need and then helps you to establish contacts.”.

Image source: China Canada Angel Alliance website

Wang Tong also said earlier: “Why do entrepreneurs take money from a Chinese institution? It’s just like why do Chinese projects take money from US dollars. It’s reasonable. If there are no industrial resources and contacts, money is just money. It’s hard to really help enterprises.”

Nicholas said that his trip to the startup camp made him clearly understand what work and resources his company would need to do if it was to be established in China. Without the introduction of China Canada Angel Alliance and on-site visits, it is difficult to obtain such first-hand information.

He was particularly impressed by the Xinghe World Industrial Park, which is located in Shenzhen and has 800 contracted enterprises, including 24 of the world’s top 500 enterprises, with an annual output value of 30 billion yuan. Nicholas was amazed at both hardware facilities and services provided to enterprises.

More fortunately, he found the “right person” in China. In the interview, he revealed that a company in Beijing was about to invest in Fibos. It was in CAMP Beijing that he met the person in charge of the company. Since then, the two sides have kept in touch. “If it wasn’t for this event, I wouldn’t have the opportunity to know them.”.

Now, Fibos is about to set up offices in Beijing and Nanjing, and begin to provide their products to Chinese power enterprises. It is estimated that by the end of 2021, China is expected to become the largest market of Fibos.

Yang Jun said that for entrepreneurs, entrepreneurial camp activities opened the door to a new world. Because the local market in Canada is small, many start-ups have an urgent need for survival. Local investors generally hope that they can be more down-to-earth, find ways to make money quickly, and then quickly sell to large companies so that investors can exit. While China has a vast market, investors’ expectations for entrepreneurial projects are not only immediate interests, but also their growth and influence.

He said: “I can clearly feel that many people are willing to work hard for a bigger goal after they come back from Beijing.”

Claudia Krywiak, the current chairman and CEO of the Ontario Center of Excellence, recognized this activity very much. She said to Yang Jun, “You not only fulfilled your commitments, but also did what others can do for years in the first year.”.

Invest first, and you can bear 90% failure with 100 times of return

Over the past six years, the China Canada Angel Alliance has invested more than 40 Canadian start-ups, with a cumulative investment of nearly US $10 million.

Zhang Yiqin said that the most important consideration for angel investors to choose whether to invest in a project is “people”. The success of entrepreneurship depends 70% on whether the entrepreneur has the core competitiveness of the project, such as sales ability, technical ability, or blueprint ability. Other deficiencies can be made up by other team members. He called it the “new barrel theory”, that is, the ability that enterprise leaders are best at determines how far an enterprise can go, while in terms of comprehensive quality, they can make progress together with partners with other strengths.

“Martin is such an entrepreneur. In addition, Applyboard has targeted the broad market of studying abroad, and the business model of intelligent matching has been opened up, so this is the case.”.

Applyboard was founded just five years ago. This year, its new round of financing has reached a valuation of 1.4 billion US dollars. It has become a unicorn of education technology and a star company in Canada. The investment of Canada China Angel Alliance has yielded considerable returns.

However, the high risk of angel investment is also obvious to all. Behind the successful investment cases are often many times the failure cases, so that some people say that angel investment is the closest model to “gambling” in the investment industry. Zhang Yiqin gave his way to solve this problem.

He said that the project portfolio of angel investment should first be dispersed enough to put eggs in different baskets. Although the project “looks beautiful” during the inspection, it is difficult to judge whether it can achieve the expected effect in the end because it is in a very early stage. If you only invest in a small number of projects, it is likely that the most successful one is not in the scope of investment. However, if 100 projects are invested, three or five projects may be successful and the cost can be recovered.

He referred to Bubble Mart, which was recently listed in Hong Kong. The opening of this “blind box first stock” rose by more than 100%, and its total market value exceeded 100 billion Hong Kong dollars. He said, “You never know where the next surprise will be. A friend in the circle invested in this company when its valuation was only around 10 million. His return is close to 10000 times.”.

In addition, Zhang Yiqin prefers to invest in projects with high expected returns. “High” means that the valuation at the time of exit is more than 100 times the valuation at the time of investment. “If it is less than 50 times, I will not consider it.”.

He said: “Only a hundred times return can cover 90% of the failure rate of other projects. To survive in the investment industry, we must design self consistent rules of the game.”